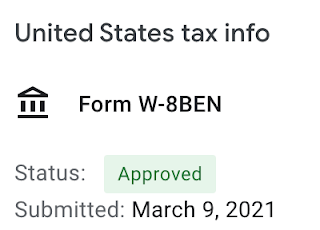

US Tax Information On YouTube AdSense Earning 10 March, Approved Status

US Tax Information On YouTube AdSense Earning Form W-8BEN or Form W-8BEN-E US Tax Information manage AdSense For YouTube Earnings US 30 Percent Taxes on manage tax information AdSense Approved Status Additional Tax Info on Your US Earning Through AdSense. Here is Update to All YouTube creators and partners are required to submit tax information to ensure any applicable taxes on your payments are accurate.

Submit US Tax information On YouTube AdSense Earning Latest News 10 March 2021: We’re reaching out because Google will be required to deduct U.S. taxes from payments to creators outside of the U.S. later this year (as early as June 2021). Over the next few weeks, we’ll be asking you to submit your tax info in AdSense to determine the correct amount of taxes to deduct, if any apply. If your tax info isn’t provided by May 31, 2021, Google may be required to deduct up to 24% of your total earnings worldwide.

US Tax Info For YouTube Creators in Hindi: US टैक्स इंफ़ो का फ़ॉर्म भरने में कोई problem नहीं आएगी। बस आपको individual के रूप में भरना होगा और जल्द आपको Gmail पर message आ जाएगा।

What Will Happen If you not Complete Your Manage Tax Information Form of Your AdSense Account: So Your Earning will be on Hold and 24 % monthly cut on your worldwide earning.

How To Fill YouTube US Tax Information Form W-8BEN or Form W-8BEN-E: In the next few weeks you will receive an email to submit your tax information in AdSense. The online tax tool in AdSense is six steps and will ask you a series of questions to guide you through the process to determine if any U.S. taxes apply. For more information on these changes and a list of tax info to prepare, visit our Help Center.

Why is this happening? Google has a responsibility under Chapter 3 of the U.S. Internal Revenue Code to collect tax info from all monetizing creators outside of the U.S. and deduct taxes in certain instances when they earn income from viewers in the U.S.

For creators outside of the U.S., we will soon be updating our Terms of Service where your earnings from YouTube will be considered royalties from a U.S. tax perspective. This may impact the way your earnings are taxed, and as required by U.S. law, Google will deduct taxes.

How will my earnings be impacted? If you provide your tax info, U.S. taxes may only be applied to your monthly U.S. earnings from AdSense (revenue earned from viewers in the U.S. through ad views, YouTube Premium, Super Chat, Super Stickers, and Channel Memberships). If no tax info is provided, your tax rate may default to the higher individual backup withholding rate (24% of total earnings worldwide). To estimate the potential impact on your earnings follow these instructions.

Comments

Post a Comment

Comment will be Visible after approval, आपका कॉमेंट जल्द दिखेगा